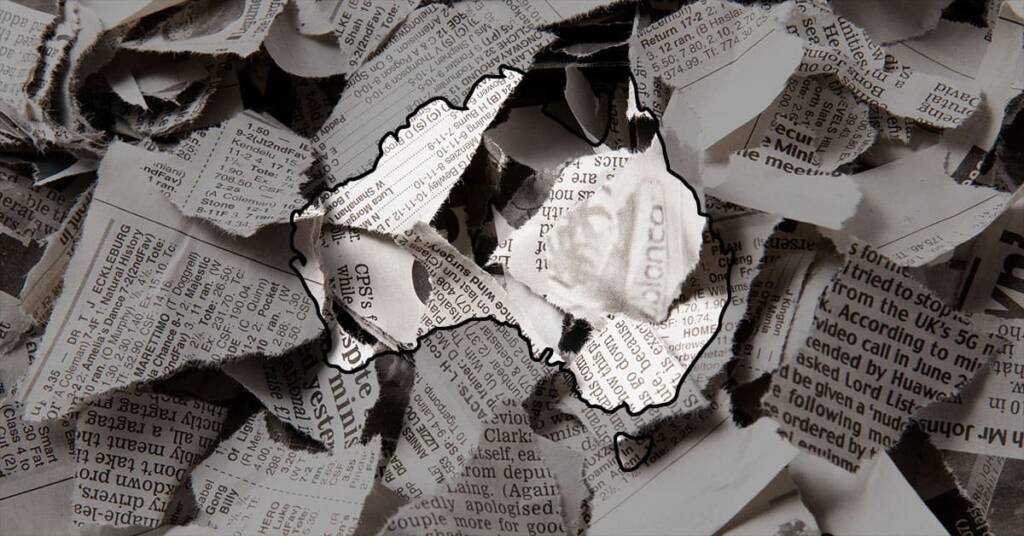

In an unprecedented move, the Reserve Bank of Australia (RBA) recently increased its cash rate by 25 basis points to 4.35%, ending four months of steady policy1. This decision has prompted all of Australia’s big four banks – Commonwealth Bank of Australia (CBA), National Australia Bank (NAB), Australia and New Zealand Banking Group (ANZ), and Westpac – to hike their home loan rates2.

For many Australian homeowners, this has created a new financial landscape that requires careful navigation. If you’re one of the many Australians affected by this rate hike, here are some practical tips on how to manage your mortgage payments and potentially save money in the long run:

In an unprecedented move, the Reserve Bank of Australia (RBA) recently increased its cash rate by 25 basis points to 4.35%, ending four months of steady policy.

Reuters

1. Consider Refinancing:

If your current bank has increased rates significantly, it might be worth shopping around to see if you can get a better deal elsewhere. Remember, even a small decrease in interest rate can lead to significant savings over the life of your loan.

2. Make Extra Repayments:

If possible, making extra repayments can help you pay off your loan quicker and save on interest. Check with your lender to see if there are any penalties for making additional repayments.

3. Review Your Budget:

With higher loan repayments, now is a good time to review your budget. Look for areas where you can cut back and redirect those funds towards your mortgage.

4. Consult a Financial Adviser:

A financial adviser or a mortgage broker can provide tailored advice based on your specific circumstances.

It’s important to remember that while the rate hike may increase your mortgage repayments in the short term, there are strategies available to manage this change and maintain financial stability. Stay informed and consider seeking professional advice to navigate these changes effectively.

Stay tuned to our website for more updates and insights on the Australian mortgage industry.

Footnotes

- Reuters ↩

- Yahoo Finance ↩